Prepare your fact based negotiations!

Access the cost data you need in order to get the most out of your suppliers, with data tailored for your specific situation.

Product

In response to customer demand in today's turbulent world!

We have developed a highly affordable and in-demand overview package featuring 18 key indicators – a unique service designed to provide valuable insights for your entire company. The service includes access for an unlimited number of users within your organization.

Interested? Contact us through the form further down the page!

Product

Prognos Tailored

From our platform Prognos Tailored you can access interactive, continuously updated, reports where you can drill down in your materials, compare the prices to your own cost development, export the graphs, or export the underlying data for further analysis. The reports are customized for you by Prognos, leaving you to focus on the negotiation strategy and not on finding the data.

Course

Should-Cost Analysis Course

Our course is designed to empower you with the tools, techniques, and strategies to transform the way you approach sourcing. If you are ready to do the job, you won't just attend supplier negotiations - you’ll own them.

Services

Our Data

The Prognos System gathers data from multiple sources to give you up to date data in one place.

Raw Materials

Raw Material Costs from all over the globe. Obtained from multiple sources and combined into one central source.

Manufacturing Costs

Manufacturing costs are calculated from hourly wage development, equipment cost and real estate prices.

Tax & Transport

Transportation rates and taxation tariffs gathered from the country official sources.

Labour Costs

Labour costs from different sectors in different countries over time.

Currencies

Currency data enabling you to view all transactions in different currencies and see currency effects on your trade portfolio.

Features

Prognos Features

Different types of interactive models and reports are delivered through the Prognos Tailored platform. Each report is tailored to your organisation's specific needs and purchasing behaviour.

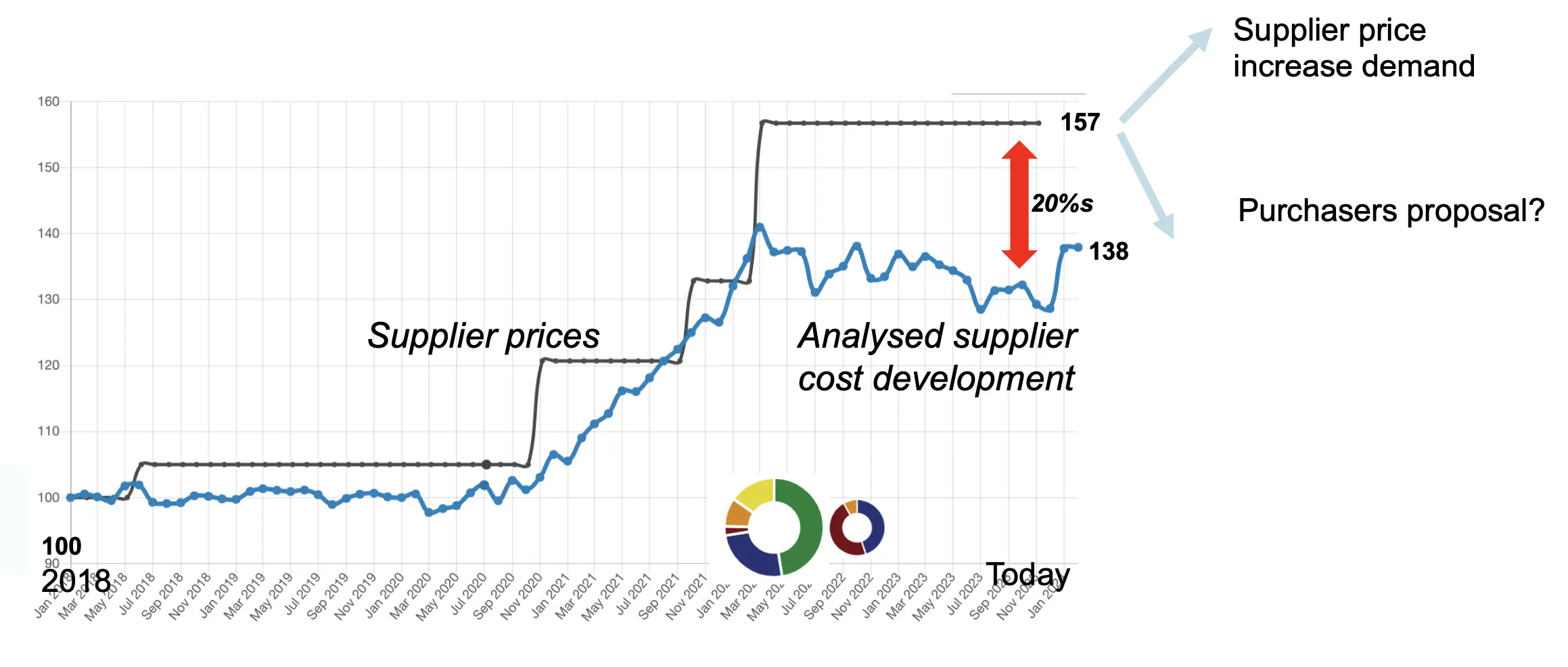

Should Cost Tracker

The Should Cost Tracker keeps the strategic purchaser updated on all key cost changes at your main suppliers and products. Our Prognos experts analyse the cost structure of your product and deliver a tailored report with indices for all included cost drivers.

Selected Indices

Our experts select indices that are important for your products, suppliers and organisation from our database with over eight thousand indices.

Country Focus

Understand your key supplier markets. Get data on cost drivers like labour costs, currency and manufacturing costs and other general economic indicators regarding a certain supplier country.

Achievements

40 years

Of Experience

1000+

Clients Served

3000+

Reports Curated

Get In Touch

Please fill the fields below and we will get in touch with you if you have any queries.

Erik Lehman

Business Developer, New Customer Contact